SCOPE OF ELECTRIC VEHICLES IN INDIA AND LISTED COMPANIES

CURRENT STAGE OF EV IN INDIA

In the first quarter of FY23, a record-breaking 2,22,208 units of EV have been sold in the entire country. To put in Comparison 31,315 units of EV had been sold in Q1 of FY22, since then, there has been a Y-o-Y growth of 610%.

The demand for electric vehicles is continuously rising and on top of that UNION Minister Nitin Gadkari has said that within 2 years, electric vehicles will cost the same as petrol vehicles. If this happens then this will further boost the EV industry sales.

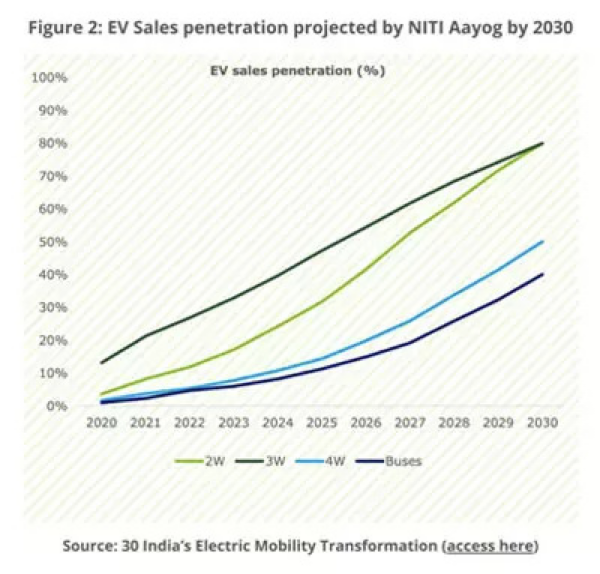

Even though in the overall market, sales penetration of EVs was only 0.77%, as per IESA the EV Industry in India is expected to grow at a CAGR of 36%.

BENEFITS OF CHOOSING EV

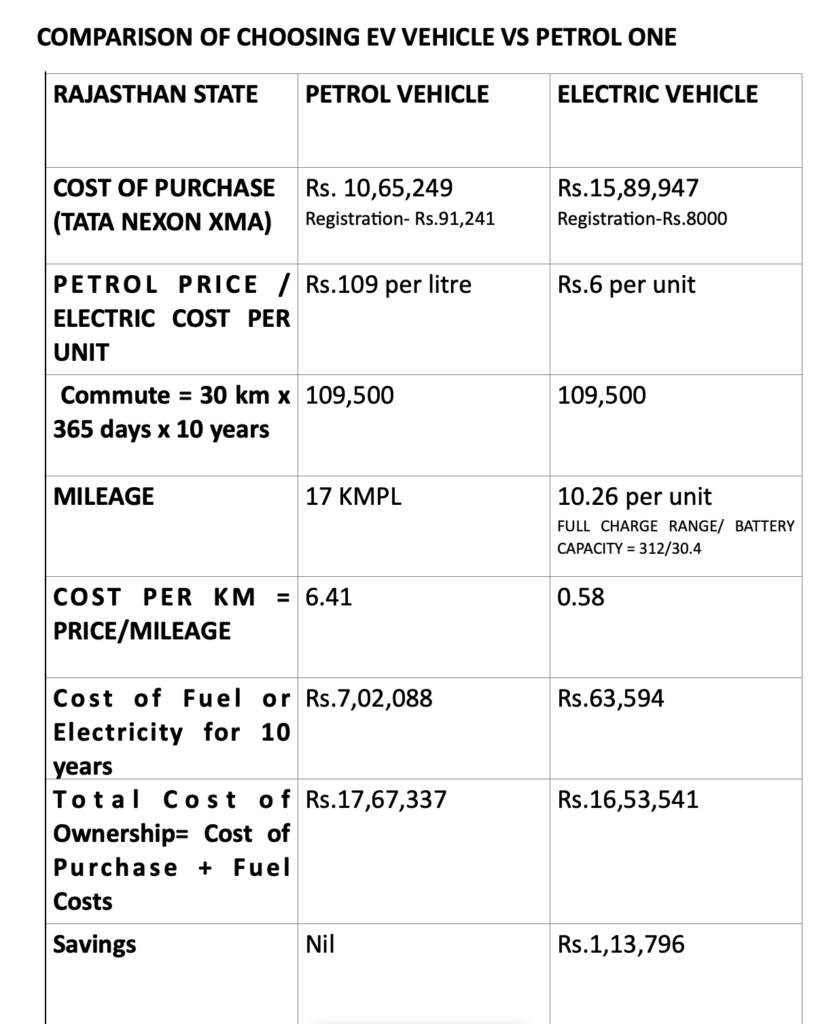

- Do Not Have To Worry About Rising Petrol Costs: In many cities, the price of petrol has gone over Rs.100 and this expense can continuously rise but in EV, you can travel at costs of as low as Rs.1 per km.

- Subsidies Given By Government: Purchasing costs can be minimised to some extent for EV vehicles due to subsidies provided by the government.

- Contribution To Reducing Carbon Emissions: EVs have led to a million tonnes of reduction in carbon emissions. If you choose an EV over petrol, you will contribute to reducing pollution and saving the environment.

- Low Maintenance Costs: Electric Vehicles have fewer components to maintain than an ICE vehicle, this ultimately reduces the maintenance costs incurred on vehicles.

- Easy Charging From Home: If you own an EV, then you can easily charge your vehicle from home. Keep it on charging overnight and it’s ready to use the next day. The infrastructure is in the developing stage right now.

PROBLEMS IN EV

- Lack of Charging Infrastructure: A major problem faced in this industry is the lack of charging stations, in India, only 1742 public charging stations are there for 10 lakh EVs. India has to boost its charging infrastructure only then people will be inclined toward buying battery-powered vehicles.

- Higher Costs: An Indian consumer is a very economical consumer, he/she will think twice or thrice before buying a product that they have never bought, same goes for electric vehicles. As EVs are relatively more expensive than ICE(Internal Combustion Engine) Vehicles, they are not considered by people who do not commute much.

E.g.: Tata Nexon XM costs Rs 8,59,500 while the same model in EV costs Rs 14,99,000.

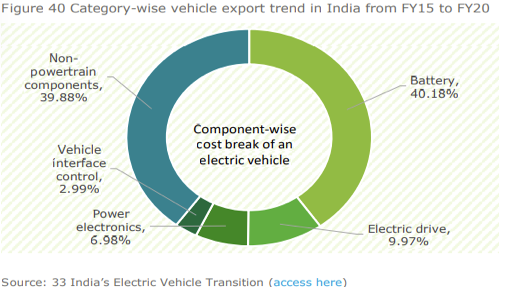

This is mainly because the 40% cost of an EV is associated with its battery which is made of lithium-ion.

- Limited Options: In India’s EV industry of India there are very limited options to consider for the consumer. In normal ICE vehicles, consumers have a range of choices so they can easily choose a vehicle for their needs. With time, more and more EV options are coming but at present EV industry in India is at a nascent stage.

STATE GOVERNMENT POLICIES AND SUBSIDIES

1.Delhi:

-Aims at 25% of new vehicle registrations to be electric by 2023

-25% purchase incentive on MRP of e-cycles up to 5500

-Subsidy of up to rs30000 on 2-wheeler and rs150000 on 4-wheeler along with the waiver of road tax and registration charges

2. Uttrakhand

-Aimed at making Uttarakhand a preferred destination for investment in EV manufacturing capacity

-Special focus on developing green highways in Dehradun, Haridwar, Rishikesh, Haldwani, Rudrapur and Kashipur

-Term loans in the range of Rs.100 million to Rs.500 million will be provided to micro, small and medium enterprises interested in manufacturing EVs

3. Maharashtra

-Scrapping incentives of up to 7000, 15000, and 20000 on 2w,3w, and 4w respectively

-All the EVs sold in the state shall be exempted from road tax till the duration of the policy

-Incentives of Rs.5000/kWh on 2w, 3w(autos), and 4w(private cars) with a maximum of 10000, 30000, and 40000 respectively.

FUTURE OF EV

The EV Industry is growing at a rapid pace and as per SMEV, it has the potential to grow more than 5% share of total vehicle sales in a few years.

The major cost of the electric vehicle is the battery component as per the below graph but this is planned to come down to 18% by 2030. Battery manufacturing companies are going to have a big role in making this possible.

SOME PROMINENT AUTOMOBILE EV STOCKS

1.Tata Motors:

-It is trading for ₹423.5 and has a high debt to equity ratio of 3.29 which is unfavourable.

-It has also slipped to third place in sales as Hyundai Motors surpassed it to become 2nd.

-Tata Motors has the highest sales for 4-wheeler EV cars in India and has bagged an order for 1180 electric buses by WBTC. (WEST BENGAL TRANSPORT CORPORATION)

2.Mahindra and Mahindra:

-It is trading at a price of ₹1274.

-Its P/E ratio is 24.46 which might seem high but it’s near to its median P/E of 23.2 which means it’s in a good position and not overvalued.

-Its 5 years profit growth is 12.82 but its 5 years sales growth is only 1.48%.

-M&M has announced its EV lineup in the 4-wheeler segment and will launch the first one in September 2022, while it leads in the 3-wheeler segment with a 70% market share.

3.TVS Motor Company Ltd:

-It is a prominent stock in the 2-wheeler EV industry.

-TVS sold 6304 units of its flagship 2-wheeler EV TVs iQube electric.

-It is trading for ₹1038.20 and it has a P/E ratio of 41.98 with a median P/E of 39.5.

-Its 5-year sales growth was 14.34% and its 5-year profit growth was 8.13%.

-It had a high D/E ratio of 3.60.

4.Exide Industries Ltd.:

-It manufactures automotive, industrial and submarine storage batteries.

-It’s trading for ₹158.60. It’s an undervalued stock as its median P/E is 21.7 but its actual P/E is 2.8.

-Its 5-year profit growth is 40.30%. The company is almost debt free.

-In June 2018, Exide industries and Leclanche, a world-leading provider of high-quality energy storage solutions, entered a joint venture (JV) agreement to build lithium-ion batteries to cater to India’s booming EV market.

5.Olectra Greentech:

-One of the major players in the EV sector as 70% of its revenue comes from electric buses.

-It’s trading at a price of Rs.598.85. It has had a sales growth of 175.97%.

-FIIs have increased from 2.93% in Sep 2019 to 9.02% in June 2022. Its Profit growth of 5 years is 34.42%.

Happy Investing!

4 thoughts on “SCOPE OF ELECTRIC VEHICLES IN INDIA AND LISTED COMPANIES”

Good knowledge

Good work

Good suggestions are given by ur team

Need more on rv